Wednesday, 3rd December 2025

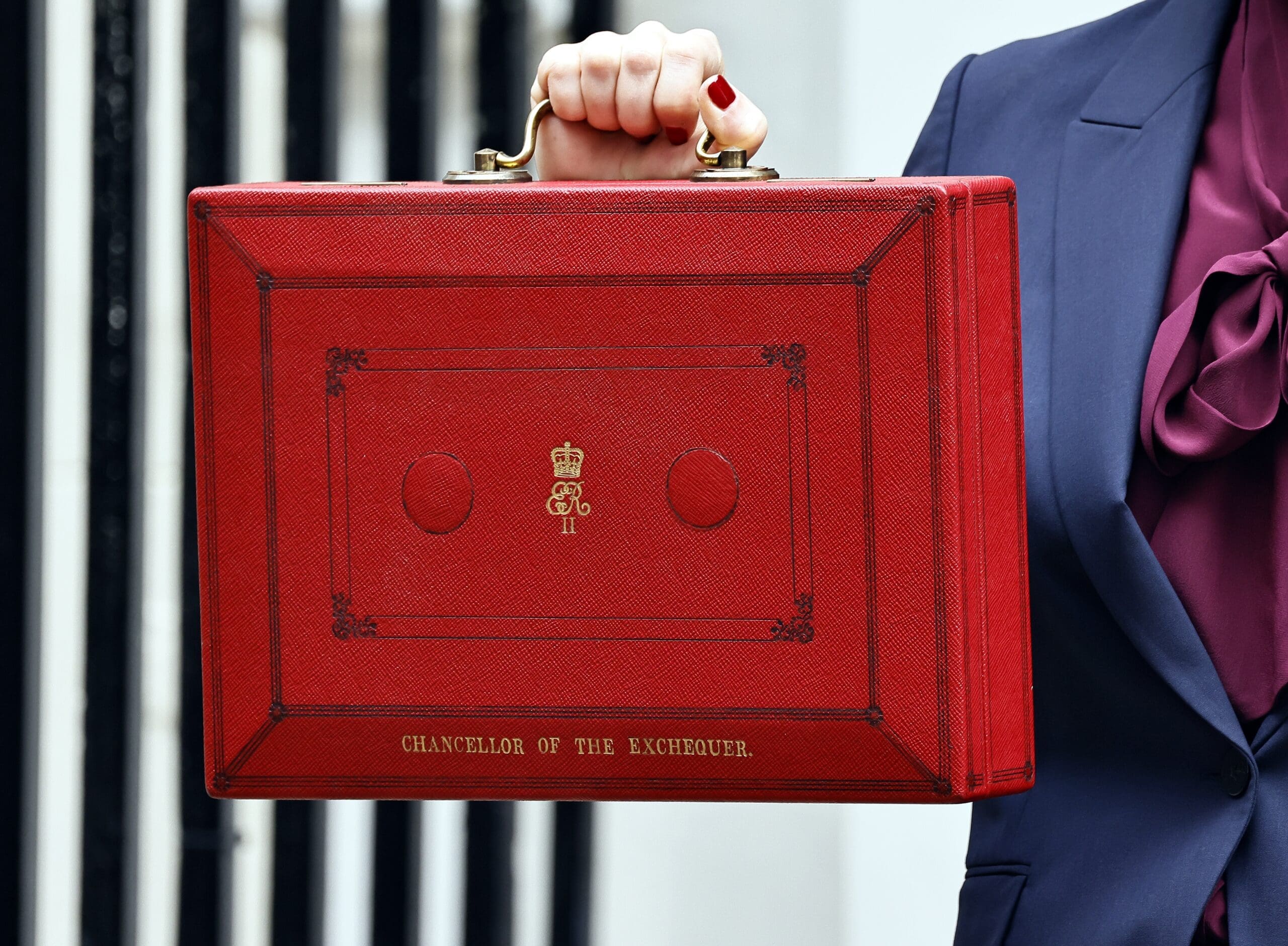

Wednesday, 3rd December 2025Budget 2025 – Inheritance Tax escapes the spotlight

In the run up to the Autumn Budget 2025, many of my clients and contacts were concerned that the Chancellor would make Inheritance Tax (IHT) even more punishing. My instinct was that she would not do so, having made substantial changes to the IHT regime in 2024. I was pleased to be proved right. Yet, there is a reason why IHT is always expected to be increased: the tax is due for reform.

Over the last decade, report after report has made clear the need for IHT to be reformed. The Institute for Fiscal Studies, the Office of Tax Simplification, and an All-Party Parliamentary Group have all come to this conclusion. Yet the Chancellor’s appetite for change, it seems, has so far been simply to increase the burden on farmers, business owners, and the middlingly wealthy without making the tax fit for the modern day.

As such, there are tools in the chest that have not yet been used, and families should be aware of them.

What changes did the Budget 2025 make?

- The nil-rate band (NRB) of £325,000 and the residence nil-rate band (RNRB) of £175,000 will remain frozen until April 5, 2031.

- The £1 million cap for combined Agricultural and Business Reliefs, effective from April 2026, will be transferable between spouses or civil partners.

- Relevant property trust charges for historic trusts settled by formerly non-domiciled individuals will be capped at £5 million from April 6, 2025.

- Payments from Infected Blood Compensation Schemes will be exempt from IHT.

- The IHT exemption for gifts to charity will only apply to gifts made directly to UK charities and Community Amateur Sports Clubs.

What widely recommended measures were not in the Budget?

- The ‘seven-year rule’ survives another day.

As other routes are closed off one-by-one, the best IHT mitigation strategy is increasingly for wealthier individuals to pass assets down to their families whilst they are young and in good health. As a general rule, if such gifts are made over seven years before death, they are free from IHT. Reports often call for the removal of this rule. Some call for a simple ‘gifting tax’ to be created to remove lifetime gifts from the IHT regime entirely.

- The RNRB remains in place.

Criticized for its complexity, and for favouring individuals with children and property, there are frequent calls for this relief to be abolished, and for the ordinary NRB to be expanded.

- Reliefs such as Business Relief and Agricultural Relief, though limited, remain in place.

Many stakeholders have called for reliefs to be abolished entirely, and the rate of tax lowered. Instead, across her Budgets to date, the Chancellor has chosen to bring more assets into the tax, and hold the rate.

How should families interpret this Budget?

As we enter an era of political populism and economic uncertainty, with potentially significant disruption brought about by transformative technologies, it seems unlikely that IHT in its current form will hold. This Budget was a relatively soft-landing for those worried about further changes, but they should not sit on their hands as a result. Wealthier individuals should use the next year to consider their families’ needs and put gifting plans in place, whilst they still can.

If you have any queries regarding this note or require further information about anything covered in it, do get in touch with Alex Shah, Henry Braithwaite or your usual contact at the firm on +44 (0)20 7526 6000.

This article is for general purpose and guidance only and does not constitute legal advice. It should not replace legal advice tailored to your specific circumstances.